Metavault Trade

When we want to invest or spend a lot of money on something, we all have high demands for the end result and quality. And for good results, the management must be very strict and always under our control. If you are an e-marketer or your work is related to e-marketplaces, then I believe you have a good understanding of blockchain transparency and clarity.

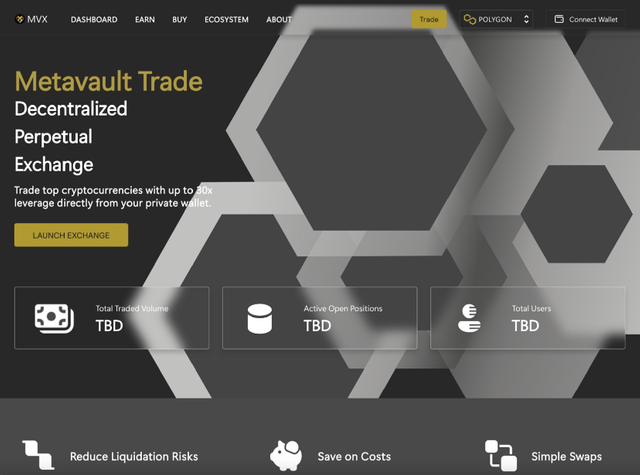

Metavault.Trade is an exchange platform that provides decentralized crypto exchange services designed with various crypto features. Metavault.Trade provides spot & perpetual exchange services that allow users to trade with up to 30x leverage and directly from their personal wallet. Metavault.Trade is an innovative decentralized exchange platform as it provides spot & perpetual exchange services where users can trade safely and easily without going through an account, but simply by connecting their wallet and they will be able to trade. So it is a decentralized crypto exchange platform with leverage and convenience for users.

What is Metavault.Trade?

Metavault.Trade is a new type of Decentralized Exchange designed to provide a wide range of trading features and very deep liquidity on many large cap crypto assets. With Metavault Trade you can trade top cryptocurrencies with up to 30x leverage right from your personal wallet. Metavault.Trade is a state-of-the-art Decentralized Exchange platform that does not require registration. To start trading in Metavault. Trade all you need is a Web3 wallet.

Metavault Trade is a decentralized and perpetual exchange with low swap fees and trading without price impact. Trading is supported by multi-asset pools, which in turn are backed by liquidity providers.

Trading is supported by multi-asset pools, which in turn are backed by liquidity providers. Liquidity providers are rewarded through swap fees, market building, rebalancing and leveraged trading. MVX uses Oracle Chainlink and TWAP pricing from a large volume decentralized exchange for dynamic pricing.

Problem

Most of today's crypto users trade through centralized exchange platforms. Through this exchange platform, users will be able to trade crypto easily and securely. But the problem is that usually centralized exchange platforms use KYC for their trading which is problematic for some as it is related to their identity and privacy. Whereas users should be facilitated with a crypto trading platform that will make it easier for them to trade and not ask for their identity so that users will be able to trade freely without worrying about their privacy.

The solution

And in response to this issue, Metavault.Trade was launched as a decentralized exchange platform that would not question the identity of its users. This service is provided by Metavault.Trade is a decentralized & perpetual exchange, which will allow users to trade quickly and securely with leverage through their personal wallets. Since it only requires a connection to the user's digital wallet, it means that Metavault.Trade does not require the creation of an account for the user. Users will be able to trade their favorite pairs freely without worrying about their privacy.

Metavault Exchange Features

Low Fees - Very low transaction fees.

No price influence, even for large order sizes.

Simple Swap - Open positions via a simple swap interface. Easily swap from any supported asset to your preferred position.

Reduced Liquidation Risk - Protection against liquidation events: sudden price changes that often occur in a single exchange (“scam wicks”) are smoothed out by the design of the price mechanism.

Complete platform: spot trading and leverage.

Multi-asset pools - The key innovation at the heart of Metavault.Trade is multi-asset pools. This feature allows the platform to share liquidity across all the assets it supports.

Metavault.Trade . Ecosystem

MVLP ( Liquidity Provision Incentive) - MVLP is a platform liquidity token. Metavault.Trade requires a multi-asset pool with a lot of liquidity. To ensure this happens, the platform has a very generous incentive program: 70% of the platform fees are redistributed to liquidity providers who score MVLP by accumulating their crypto assets. MVLP acts as a counterweight to leverage traders on the platform, with their losses flowing back into MVLP.

MVX - Metavault.Trade has its own governance and utility token: MVX. Holders are incentivized to stick around for the long term, with many rewards accumulating quickly. MVX marketers will get 30% of the fees collected by the platform in the form of the network's native token — MATIC on Polygon.

How to Buy The Continental & Trade On Exchange?

Metavault Trade Decentralized Perpetual Exchange

Trade Top Cryptocurrencies With Up To 30x Leverage Directly From Your Personal Wallet.

Reducing Liquidation Risk

High Quality Price Feed Aggregate Determines When Liquidation Occurs. This Maintains The Safe Position Of The Axis Temporarily.

Save Cost

Enter And Exit Positions With Minimal Spreads And Zero Price Impact. Get Optimal Prices Without Incurring Additional Costs.

Simple Exchange

Open Positions Through Simple Swap Interface. Easily Switch From Supported Assets To Your Preferred Position.

Available On The Following Networks

Metavault Trade Currently Used For Opera.Near Protocol Polygon And Fantom Networks Coming Soon.

Buy and sell

Metavault.Trade Is A Decentralized Exchange Platform That Does Not Require Registration. To Start Trading On Metavault.Trade All You Need is a Web3 Wallet.

Connect Wallet

Connect Your Wallet By Clicking "Connect Wallet" Button In Header.

Der Multi-Asset-Pool

The big innovation at the heart of GMX and now Metavault.Trade is a multi-asset pool. All assets supported by the platform are pooled and a token called MVLP represents the index of that token. The price of the MVLP fluctuates with the price of the underlying asset in the basket and the trader's profit and loss (PnL) — if they lose a trade, their losses flow to the MVLP.

How does this shared liquidity result in a swap solution with a lower price impact? For example, let's say the pool is made up of five assets (BTC, ETH, MATIC, USDC, and DAI) divided equally in terms of dollar value: 20% each. If a trader wants to buy 50% of the BTC supply with USDC, they can do so immediately with no price impact. Once the order is placed, the pool status becomes BTC: 10%, USDC: 30% and the rest remains unchanged. To understand how unique this feature is, I suggest you check how much price impact you receive for a very large order on CEX with an order book or on a DEX like Uniswap!

At launch, the assets backed in Polygon will be six large caps and three stablecoins:

BTC, ETH, MATIC, LINK, UNI, AAVE

USDC, DAI, USDT

Now let's go back to the pool in the example above. After the exchange, it was unbalanced compared to its initial state. Liquidity providers will be incentivized to deposit BTC and discouraged from depositing USDC, which will result in pool rebalancing.

What the Metavault.Trade multi-asset pool looks like — © Metavault.Trade

Metavault.Trade will also allow traders to take long or short positions on these assets with up to 30x leverage. The main innovation here is the way of pricing: the platform combines Chainlink pricing and Time-Weighted Average Price (TWAP) from major DEXs and CEXs. This greatly reduces the risk of liquidation of the temporary axes that you find on some exchanges. This is sometimes because the big players intentionally manipulate the order book to liquidate other users. In this case, they are referred to as "axes of deception"!

Simple interface to choose long, short or simply trade your assets — © Metavault.Trade

Alfa

In my opinion, Metavault.Trade is likely to be adopted by two different types of users:

Use it for traders looking for a decentralized platform and/or fraud protection.

Users who need to trade large amounts of assets and find there a better price than AMM or even other CEX.

The general consensus is that decentralized perpetual trading is still massively undervalued as a vertical and it will capture the ever-increasing share of the crypto trading market – much to the detriment of CEX.

That alone would make it a project worth investigating; Also, I think you should consider what happened to GMX: it was a huge success for those early in the game either providing liquidity or buying platform utilities and $GMX governance tokens.

In my opinion, Metavault.Trade gives everyone the opportunity to participate early in projects of the same quality as GMX and even with special advantages:

It is built on top of Polygon, a chain where transactions are fast, inexpensive, and user orientation is easy. Without going into too much technical detail, there's more to the Chainlink feed in Polygon than the chain on which GMX is active, and this is critical for pricing and making listing new assets easier.

Its tokenomics allow for more incentives. The history of GMX is a bit complicated, it is a rebranding of the BSC Gambit project, and a large part of GMX's offering was allocated to previous Gambit investors. Metavault.Trade has no previous investors and this allows the protocol to reserve a larger proportion of tokens for farm rewards compared to GMX.

A vibrant and engaged community. Metavault.Trade is part of the entire blockchain ecosystem and technology project under the Metavault DAO umbrella. They have an A-Team of developers and many dedicated community members to support their efforts.

MVLP

MVLP is a token whose value consists of an index of assets used in swap and leverage trading. User Can Print MVLP Using Any Index Asset Or Burn It To Collect Index Asset. The Printing Or Redemption Price Is The Combined Value Of The Indexed Assets / MVLP Supply. MVLP Holders Earn EsMVX. Because MVLP Holders Provide The Necessary Liquidity For Leverage Trading, They Profit During Metavault. Trader Leverage Trader Makes a Losing Trade. They Also Lose When Leverage Merchants Make Profitable Trades, With Their Guaranteed Towards Payouts.

Team

Metavault.Trade is built by professionals and experts in their field who have years of experience in blockchain technology and understand the crypto market. The team collaborated together in developing a decentralized exchange that would be used by many people globally easily and securely. With this collaboration, it is hoped that users can get the best service, where they can transact safely, quickly, and at lower costs through their devices.

Summary

Metavault.trade is probably one of the best solutions I've seen in the last year. Therefore, if you have the desire and ability, you can easily become part of a powerful project, the token is hosting IDO and will continue to this day.

But for more details about the project, I invite you to take a look at the next part of the article where you will find all the official social links to the project. With your help, you can not only add information about the aspects that I have already talked about, but also understand all the subtleties and nuances. I hope this article was useful for you. If so, write about it in the comments.

$MVS $MVSP

Further information:

Website: https://metavault.trade

Telegram: https://t.me/MetavaultTrade

Twitter: https://twitter.com/MetavaultDAO

Medium: https://metavault.medium.com

Discord: https://discord. com/invite/b2fPrbmPza

Github: https://github.com/metavaultorg

Documents: https://docs.metavault.trade

Username: tsaniyaah Link: https://bitcointalk.org/index.php?action=profile;u=2579389

Komentar

Posting Komentar